Hasbro’s Chris Cocks on AI, Tariffs, and ‘A Lifetime of Play’

2.13.2026, 12:00:00 AM

2.13.2026, 12:00:00 AM

121

121

2.13.2026, 12:00:00 AM

2.13.2026, 12:00:00 AM

121

121

Hasbro set the tone for toy industry earnings season with a surprise, double-digit revenue increase in 2025, spiked by even bigger growth in the fourth quarter. Magic: The Gathering has a record-breaking year for Hasbro’s Wizards of the Coast, while the triple-whammy of new licensing deals for Voltron, Street Fighter, and Harry Potter products fueled momentum.

Following the company’s earnings call this morning, and ahead of Toy Fair in New York this week, The Toy Book caught up with Hasbro CEO Chris Cocks for insights on tariffs, the use of AI-driven tools in product development, licensing growth, and the company’s long-term vision.

Diversification in an Unpredictable World

Reflecting on the tumultuous tariff environment the company faced last year, Cocks says the most significant lesson was the importance of flexibility over scale.

“Our biggest learning is diversification,” Cocks says. “Prior to tariffs, we would have all said, ‘No, you gotta scale, you gotta consolidate, you gotta scale.’ But in a fairly unpredictable tariff policy environment, you really need diversification and flexibility.”

That shift has changed how Hasbro manages disruption.

“Occasionally you have suppliers with wobbles or problems,” he explains. “What five years ago might have been a significant revenue gap is now more of a temporary blip for a quarter that we can catch up on a couple of months later.”

AI-Driven Product Acceleration

On an earnings call with analysts this morning, Cocks said that Hasbro is “taking a human-centric, creator-led approach” to help teams move faster, but those teams have a choice in how they use the tech, including not using it at all. “Great IP plus great storytelling is durable as technology evolves, and it positions us to benefit from disruption rather than being displaced by it,” Cocks said on today’s earnings call.

The right tools can help save a million hours of low-value work, allowing the team to focus on more impactful tasks. One area already benefiting is in product development.

“We’ve cut about 80% of the time from concept to prototype,” Cocks tells The Toy Book. “Where before we might have had two or three cuts at an idea, now we can have 200 or 300.”

Designers can quickly generate concepts, turn them into early 3D models, and produce full-color prototypes in days rather than months.

“It’s not like we’re making fewer prototypes,” he says. “Instead of making 10, we’re making 100 — and we’re doing it cheaper than what it used to cost to make 10. With more prototypes to choose from, we can select a better toy because humans are visual. We need to see it, play with it, and touch it.”

While final product development still relies on traditional, hands-on, very human design processes, Cocks says AI is transforming the earliest stages of innovation.

“Getting through that ideation stage with stronger concepts and more concepts to choose from is pretty incredible.”

Inventory Discipline

Operationally, inventory remains a balancing act.

“We ended the year a little light,” Cocks says. “We like to be in the 90 to 100 days-on-hand range for healthy replenishment and fulfillment. We were closer to 70 to 80.”

Retail partners face similar dynamics, with both sides working to maintain optimal inventory flow without excess, something that plagued the industry after pandemic-era overproduction.

Licensing is Doing Big Business

Although licensing appeared flat in 2025 due to normalization in Trading Card Games, specifically Kayou’s My Little Pony TCG, which debuted in 2024, Cocks remains confident in long-term growth.

“We’re pretty bullish on licensing,” he says. “Our toy license business, location-based entertainment, music and publishing, and soft goods all had a really good year. Trading cards had a monster 2024 and came back to something more sustainable in 2025.”

He expects licensing to grow alongside, or slightly faster than, merchandise sales.

“We still see penetration opportunities. Our out-licensed toy business had POS growth of about 14 to 15% in a market that was basically flat, excluding TCGs.”

Cocks notes that “vault brands” remain prime fodder for deals with “companies that are scrappy and fast to market.”

Notable licensees include Just Play, Basic Fun!, and The Loyal Subjects, among others. And, just this week, Super7 revealed plans for Visionairies, retro My Little Pony, and Furby collectibles.

The GEM² Growth Engine

Cocks describes Hasbro’s core focus using what he calls GEM² — Gamified, Entertainment-Driven, Multi-Purchase, Multi-Generational.

“About 70 to 80% of our POS is in those segments, and probably 90 to 95% of our investment is there,” he says. “We see that as a boom market growing mid- to high-single digits this year and well into the future.”

He contrasts that with the more traditional side of the toy business.

“[Toys are] still important because it’s our first handshake with kids,” Cocks says. “But that side faces structural challenges — declining birth rates and substitution from digital. There’s still opportunity, but the long-term dynamics are different.”

Inspiring a Lifetime of Play

When asked about the overarching message Cocks hopes people will get when they think of Hasbro, the answer revealed that, at the heart of Hasbro’s long-term strategy, lies a simple yet powerful idea.

“We call our superpower ‘inspiring a lifetime of play,’” Cocks says. “We build a play-based relationship with a 2-, 3-, or 4-year-old, and we don’t stop when they turn 6 or 7 and move to video games. We extend that relationship across a lifetime of collecting, fandom, community, and play.”

For Cocks, that defines Hasbro’s identity.

“Some people skeptically ask, ‘Are you even a toy company anymore?’, Cocks explains. “My answer is an emphatic ‘Yes, we are absolutely a toy company.’ But we’re a toy company that inspires a lifetime of play, and we’re in a peer set of companies that do it similarly, but maybe not in as many categories as we do.”

Cocks feels that those peers include The LEGO Group, Popmart, Bandai Namco, and Fanatics.

“We start at a young age, but we age up, and we just lean into those GEM² dynamics,” he says. “Everything has a gamified element, an entertainment moment, or a big societal moment associated with it. It starts when you’re 4 or 5 or 8 or 10 or 11 or 12, depending on the brand, and it just never lets go of you, getting better the longer you collect or play it.”

Video Game Spending Climbs to $60.7 Billion in 2025 as New Releases Drive Momentum

U.S. video game spending in 2025 was led by hardware, subscriptions, and major Nintendo news.

Wildbrain CPLG appoints Marie Kopp as Vice President Asia-Pacific

NEW RESEARCH REVEALS FANDOM IS A FAMILY AFFAIR – AND BRANDS ARE MISSING A TRICK

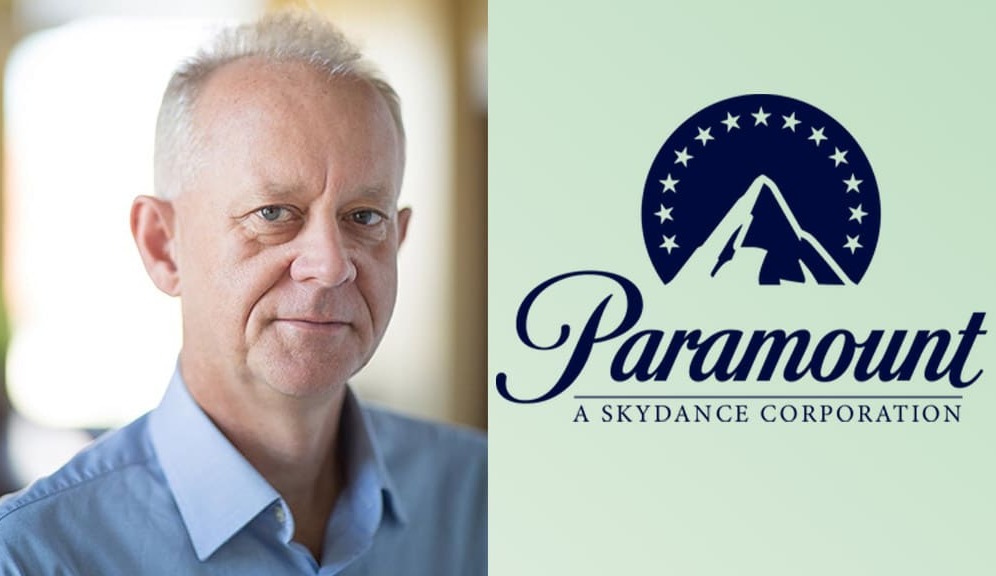

Paramount Appoints Paul Southern as EVP of Consumer Products

The former Disney Consumer Products executive has set his sights on global expansion.