Fashion Licensing at a Crossroads: How Brands Build Empires Beyond the Runway

12.5.2025, 12:00:00 AM

12.5.2025, 12:00:00 AM

502

502

Home /Media Center / Press Release / Fashion Licensing at a Crossroads: How Brands Build Empires Beyond the Runway

12.5.2025, 12:00:00 AM

12.5.2025, 12:00:00 AM

502

502

The fashion licensing landscape is transforming. At the 2025 Fashion Licensing Summit, industry leaders revealed a strategic plan illustrating how entertainment franchises, designers, and lifestyle brands use licensing to expand beyond retail and create immersive, multi-category brand ecosystems. From Emily in Paris becoming a global lifestyle icon to Nicole Miller‘s asset-light reinvention, storytelling, digital commerce, and private equity are reshaping fashion brand growth.

The evolution of entertainment properties into retail phenomena has fundamentally changed how brands approach licensing strategies. At the Summit, Rachel Sandler, Senior Vice President of Communications, Consumer Products & Experiences at Paramount, explained how Emily in Paris went beyond its role as a TV series to become a fully integrated lifestyle brand across fashion, beauty, travel, food and beverage, and experiential categories. The brand’s success highlights a key insight: narrative-driven intellectual properties have an inherent advantage in licensing discussions because they provide partners with a built-in consumer mythology and emotional connection that are often missing in traditional fashion labels.

Emily in Paris’s licensing strategy stands out for its ‘high-low’ partnerships. Paramount pairs luxury brands like Lancôme with mass-market names like Starbucks and Haagen-Dazs, creating consumer touchpoints that boost prestige and expand reach. This approach keeps the brand aspirational for wealthy clients and accessible for mainstream audiences. The fashion experience tour exemplifies storytelling through immersive experiences that increase engagement beyond retail.

Narrative shifts within the show’s plot structure create new commercial opportunities. Moving the story from Paris to Rome in recent seasons has opened new creative paths for category partners and enabled market penetration in regions previously inaccessible through Paris-centric storytelling. This shift highlights an underutilized competitive edge: entertainment properties with evolving narratives offer licensees ongoing renewal opportunities.

Traditionally, fine art licensing was a niche field characterized by conservative estates guarding their intellectual property and being cautious about mass-market collaborations. Andrea Fisher-Scherer, Managing Director of Merchandise Licensing at the Artists Rights Society, discussed a major shift transforming this industry: estates and institutions that were once closed to commercial partnerships are now eager to pursue mass-market collaborations. This change reflects both financial needs and cultural recognition that modern audiences seek genuine artistic engagement across various lifestyle categories.

Recent runway collaborations illustrate this shift. High-fashion designers, including Ulla Johnson, have effectively blended works by legacy artists like Lee Krasner and Helen Frankenthaler into modern clothing lines, creating dual value benefits: younger audiences are introduced to historically essential artists, while estate revenues boost through commercial collaborations. These partnerships break down traditional boundaries between fine art and fashion, positioning both as parts of a unified lifestyle narrative.

Brand licensees often favour commercially prominent artists, yet lesser-known artists frequently deliver stronger commercial results while providing licensees with greater creative freedom. This insight indicates that brand strategy is increasingly moving away from celebrity-focused IP models, with companies realizing that genuine artistic collaborations can outperform strategies based solely on name recognition.

Amazon’s role as a leading distribution channel requires an understanding of evolving retailer expectations. Paul Somerstein, Senior Partnership Development Manager for the Amazon Stores Agency Program, emphasized a key point: digital excellence is now a basic requirement, not a competitive edge. Retailers now demand complete product documentation, rich media assets, effective inventory management, and rapid stock turnover as prerequisites for consideration of a partnership.

Performance signals now influence retail access and promotional visibility. Return rates, customer review scores, and search algorithm rankings increasingly shape retailer decisions about product visibility, featured placement, and ongoing partnerships. This algorithmic gatekeeping signifies a fundamental shift in licensing power dynamics: retailers have moved from passive product distributors to active curators who strategically promote products with high consumer satisfaction metrics.

Amazon’s recognition of “elevated fan gear” as a high-growth segment highlights changing consumer tastes for premium products that blend functional athleticism with fashion. This merging of sports and fashion into trend-focused capsule collections indicates that consumer goods licensing is splitting into more specialized subcategories, with success depending on precise targeting rather than broad category appeal.

Influencer partnerships and social media commerce fundamentally change how licensed products reach consumers. Kendra Bracken-Ferguson, co-founder of LumiNicole Beauty, along with Alice Kim, founder of PerfectDD and Leslie Hall, CEO at Iced Media and Haut Drops, explained how TikTok has become the primary discovery platform for consumer goods, even though conversions occur through omnichannel channels like Amazon, Sephora, Ulta, and direct-to-consumer channels.

Brands adopting “niche-down” strategies—targeting specific consumer groups with tailored content—tend to see better engagement metrics because algorithmic platforms favour highly specific content for small, dedicated communities with strong purchasing power. This fragmentation opposes traditional mass-market licensing models that depend on broad category appeal, indicating that successful modern licensing should involve distribution across various niche segments within a portfolio rather than aiming at a single, universal audience.

Artificial intelligence search is emerging as a new entry point for commerce, with important implications for licensing strategies. ChatGPT and similar AI search interfaces now act as product discovery tools for over half of consumers in the United States. This shift means that brand searchability, AI-indexed content, and conversational commerce optimization are now as important for licensing considerations as traditional retail shelf placement.

The growing appeal of licensing businesses to institutional investors shows that licensed consumer products tend to perform better than non-licensed categories on key metrics. Mark Matheny, Operating Partner at IVEST Consumer Partners, and Andy Cohan, Co-Founder and CEO of ACI Licensing, noted that private equity is focused on brands with a clear purpose, a strong heritage, and potential for territory or category growth.

A significant institutional development involves deliberately separating intellectual property ownership from operational management. By structuring licensing businesses to keep IP ownership distinct from execution tasks, investors can facilitate easier scaling and reduce operational complexity. This structural innovation enables IP owners to monetize content through multiple licensing operators simultaneously, spreading risk and boosting revenue streams. The approach strongly contrasts with traditional integrated brand management, suggesting that future licensing may more frequently involve specialized IP ownership companies collaborating with category-specific operational partners.

NellyRodi, a creative intelligence agency tracking consumer trends across fashion, beauty, and luxury sectors, identified the Fall/Winter 2026-2027 trend framework as “Think Sensational,” emphasizing emotional, tactile, and sensory experiences. Key color palettes include intense reds and oranges, mint greens, diaphanous whites, cool pinks, and smoky greens, often used outside traditional seasonal associations, suggesting that contemporary consumers view color as contextual rather than tied to specific seasons.

Most notably, NellyRodi identified two contrasting aesthetic directions that reflect consumer desires for polarized brand positioning. “Anomaly” covers surreal, playful, maximalist, and experimental aesthetics, while “Tribes” highlights raw textures, craft elements, primitive materials, and ancestral motifs. This split suggests that successful licensing strategies must embrace aesthetic diversity, with licensees creating distinctive brand voices rather than aiming for a universal visual language. The takeaway for multi-category licensing: maintaining a consistent brand identity might require category-specific aesthetic variations instead of a single, uniform design language.

Viola Nigroni, Head of Licensing at ELLE and ELLE Decor, explained Elle’s strategic approach as a comprehensive lifestyle brand encompassing fashion, home, beauty, and experiential offerings that are expanding worldwide. The ELLE Beauty Seal serves as a credibility indicator for major beauty device and fragrance launches, suggesting that brand credibility is increasingly based on specialized expertise signals rather than broad brand recognition.

Hospitality and branded residential projects mark Elle’s next licensing frontier, bringing the publication’s Parisian aesthetic identity into physical spaces where consumer interaction goes beyond transactions to immersive lifestyle experiences. This expansion shows that modern licensing extends beyond product lines into environmental design and hospitality architecture, with successful brands translating their visual and philosophical identities across physical spaces.

Nicole Miller, a globally recognized fashion designer, and Carolyn D’Angelo, Senior Managing Director of Brand Operations at Gordon Brothers, explained how the Nicole Miller brand is moving toward an asset-light licensing model supported by investment partner Gordon Brothers. Rather than maintaining proprietary manufacturing and distribution facilities, the brand is leveraging its extensive archive of historic print designs as the creative basis across various product categories and sales channels, including QVC, TJX, and traditional wholesale outlets.

This structural approach demonstrates how heritage brands can expand without costly operational growth. By outsourcing manufacturing and distribution to specialized partners while maintaining centralized design control through biannual design summits, Nicole Miller preserves a consistent aesthetic across various consumer groups and retail environments. The model suggests that future growth for fashion brands will depend more on design leadership and brand structure than on operational expansion.

In conclusion, the 2025 Fashion Licensing Summit demonstrated that successful licensing now requires cross-disciplinary expertise. Entertainment brands need retail and digital skills similar to those of consumer goods companies. Fashion houses must enhance their capabilities in experiential design, hospitality, and spatial planning. Fine art estates should seek commercial partnerships while maintaining authenticity. Retailers must act as algorithmic curators rather than passive channels.

The summit showed that licensing now fuels brand growth, private equity, and consumer culture, beyond just revenue. Brands that balance authenticity with appeal, respect niche communities, and translate stories across products and channels will influence culture throughout the decade.

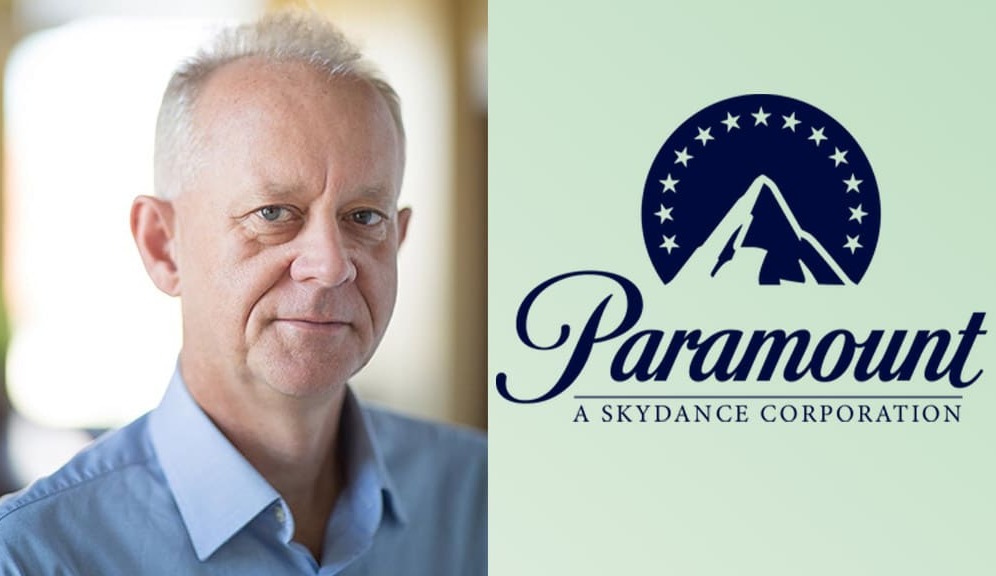

Paramount Appoints Paul Southern as EVP of Consumer Products

The former Disney Consumer Products executive has set his sights on global expansion.

Warner Bros. Celebrates 25 Years of ‘Harry Potter’ Magic

The company’s anniversary plans feature exclusive products, screenings, and more.

Video Game Spending Climbs to $60.7 Billion in 2025 as New Releases Drive Momentum

U.S. video game spending in 2025 was led by hardware, subscriptions, and major Nintendo news.

Bridgerton S4 Announces Fan Celebrations, New Collaborations & More with New Season of Love Campaign

The ‘Season of Love’ is upon us: unmask your fairytale and step into the world of Bridgerton through events, partnerships, and activations across the globe.